The Pentera Blog

More Younger Donors Are Establishing Deferred Gift Annuities, Survey Finds

The biggest news coming out of the ACGA conference in Seattle last month is that gift annuity rates are going up for the first time since 2012 - though the new rates won't be announced until May 15. But there was plenty of other fascinating information released at the conference, including the 2017 Survey of Charitable Gift Annuities. Here are two notable findings: younger donors are doing more deferred gift annuity contracts; and the net amount remaining for charities from gift annuities has continued its 20-year decline.

The 2017 Survey of Charitable Gift Annuities is the first such survey since 2013. More than 400 charitable organizations participated.

Deferred gift annuities on the rise

Deferred gift annuities now represent 13% of all annuity contracts, more than double the percent in 1994. And younger donors are establishing those deferred annuities: 27% of deferred payment annuitants are 55 years of age or younger, while just 15% were 55 or younger in 2013. That means charities are having success marketing planned gifts to younger donor prospects.

Residuum is declining

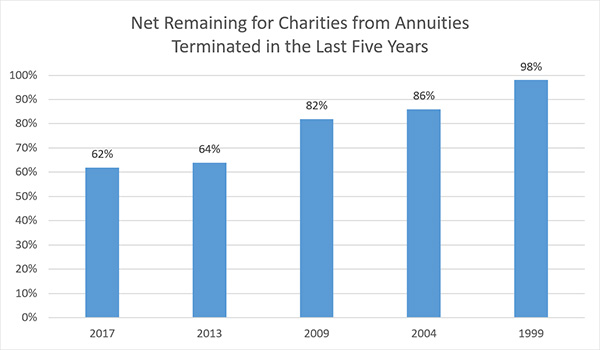

The net amount remaining for charities from gift annuities - known as the residuum - now averages 62%, down from a high of 98% in 1999. However, it is still above the 50% that the gift annuity rates are designed to return.

|

The ACGA said that the ongoing decline in the net remaining for charities has been mostly due to the performance of investments. The ACGA said that 10% of charities in the recent survey transferred funds to their reserve accounts to have enough to meet the guidelines of their states. That was down from 13% in the previous survey.

Other key findings from the 2017 survey:

- Donors who establish a gift annuity continue to be much more likely to increase their annual giving than to decrease it (25.5% to 3.6%).

- Donors who establish a gift annuity continue to be much more likely to include a gift in their estate plans than to remove a gift from their estate plans (47% to 1%).

- Female annuitants continue to outnumber male annuitants (57% to 43%).

The full survey is available free to ACGA members and for purchase to nonmembers here.