The Pentera Blog

More Men Are Replacing Charitable Giving with Impact Investing

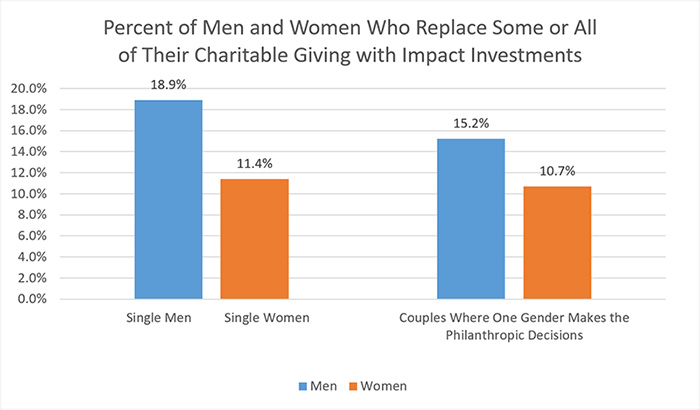

High-net-worth men are more likely than high-net-worth women to replace their charitable giving with impact investing, according to a new study. And that could mean using different planned giving strategies with those men (and the fewer women who are doing the same).

How Women and Men Approach Impact Investing was released in May by the Women's Philanthropy Institute, a part of Indiana University's Lilly Family School of Philanthropy. The study analyzes data from the Bank of America/U.S. Trust Study of High Net Worth Philanthropy series.

The study does not attempt to define impact investing but said it is generally accepted to mean investments intended to make a positive impact while generating a financial return. The concept is growing in popularity, and the term is replacing previous terms for similar concepts such as "socially responsible" investing and "mission-related" investing.

|

The study found that high-net-worth single men replace some or all of their charitable giving with impact investing 18.9% of the time, compared with just 11.4% of high-net-worth single women. High-net-worth couples in which men make the philanthropic decisions were also more likely to replace their charitable giving with impact investing. The gender differences were found to be statistically significant.

The study found that high-net-worth women engage in impact investing just as often as men, but the women are less likely to reduce their charitable giving when they are impact investing.

The study did not address specific fundraising strategies in response to the results. But one possibility is to consider that donors who replace their charitable giving with impact investing are clearly looking for a financial return while they are "making a difference." One great way to do that is with life-income gifts such as gift annuities and charitable trusts. You can explain that a life-income gift often provides higher payments than the invested asset was previously producing.

Yes, it is a gift and not an investment - the remainder goes to the charity rather than being under the control of the donor. A charitable gift leans more heavily on the side of "making a positive impact" than it does on "generating a financial return." But it could make the difference to those high-net-worth donors - particularly single males - who are considering not giving to charity at all in favor of impact investments.